Pet Insurance Market Revenue Forecast: Growth, Share, Value, and Trends By 2032

Executive Summary Pet Insurance Market :

CAGR Value:

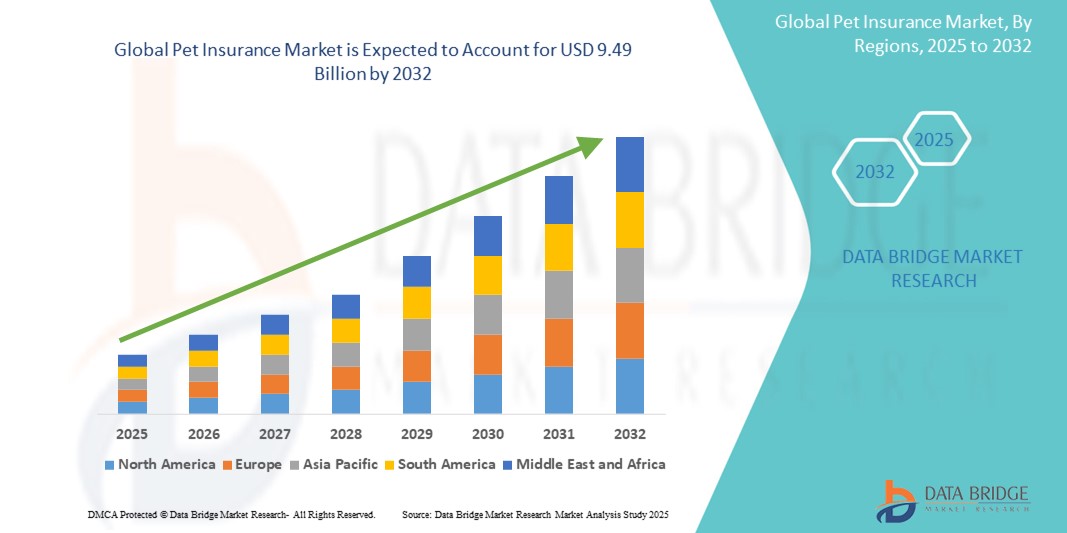

- The global pet insurance market size was valued at USD 47.32 Billion in 2024 and is expected to reach USD 9.49 Billion by 2032, at a CAGR of 94.00% during the forecast period.

All statistical and numerical data is interpreted with the use of established and advanced tools such as SWOT analysis and Porter's Five Forces Analysis. Few of the prominent features used while generating this Pet Insurance Market research report include highest level of spirit, practical solutions, committed research and analysis, modernism, integrated approaches, and most up-to-date technology. This Pet Insurance Market report recognizes and analyses the emerging trends along with major drivers, challenges and opportunities in the market. Additionally, businesses can be acquainted with the extent of the marketing problems, reasons for failure of particular product already in the market, and prospective market for a new product to be launched.

This wide-ranging Pet Insurance Market research report is sure to help grow your business in several ways. This business report encompasses a far-reaching research on the current conditions of the industry, potential of the market in the present and the future prospects. By taking into account strategic profiling of key players in the industry, comprehensively analyzing their core competencies, and their strategies such as new product launches, expansions, agreements, joint ventures, partnerships, and acquisitions, the report helps businesses improve their strategies to sell goods and services. Hence, the Pet Insurance Market report brings into the focus, the more important aspects of the market or industry.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Pet Insurance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-pet-insurance-market

Pet Insurance Market Overview

**Segments**

- **Type**: The pet insurance market can be segmented into two main types: lifetime coverage and non-lifetime coverage. Lifetime coverage provides continuous, long-term coverage for a pet's medical expenses, while non-lifetime coverage offers coverage for a specific period or condition.

- **Animal Type**: This segment can be further classified into insurance for dogs, cats, and other small animals. Different types of pets may require varying levels of insurance coverage, leading to the specialization of insurance plans for different animal types.

- **Distribution Channel**: The market can also be segmented based on distribution channels such as direct sales, veterinary clinics, and pet stores. The choice of distribution channel can impact the accessibility and reach of pet insurance plans to pet owners.

**Market Players**

- **Trupanion**: Trupanion is a leading player in the global pet insurance market, offering comprehensive insurance coverage for pets, including illness, injuries, and hereditary conditions.

- **Nationwide Pet Insurance**: Nationwide is another key player in the market, providing pet insurance plans that cover accidents, illnesses, and wellness care for pets.

- **Petplan**: Petplan is known for its customizable pet insurance plans that cater to the specific needs of pet owners, offering flexibility and comprehensive coverage options.

- **Healthy Paws Pet Insurance**: Healthy Paws specializes in providing accident and illness coverage for pets, with an emphasis on quick reimbursement and excellent customer service.

- **Embrace Pet Insurance**: Embrace is a prominent player in the pet insurance market, offering personalized plans with optional add-ons for coverage tailored to individual pet health needs.

The global pet insurance market is witnessing significant growth due to the increasing awareness among pet owners about the benefits of having insurance coverage for their beloved pets. The rise in pet adoption rates, coupled with the escalating healthcare costs for pets, has contributed to the growing demand for pet insurance products. Additionally, advancements in veterinary care and the availability of innovative treatments have further underscored the importance of having financial protection through pet insurance plans. The market is characterized by fierce competition among key players who are continuously striving to expand their product offerings, enhance customer experience, and establish strong distribution networks to cater to a diverse range of pet owners. The ongoing trend of humanization of pets, where pets are considered family members, is expected to continue driving the growth of the pet insurance market globally.

The pet insurance market is evolving at a rapid pace, driven by various factors that are reshaping the landscape of this industry. One notable trend is the increasing popularity of customized pet insurance plans that cater to the specific needs and preferences of pet owners. As pet owners become more discerning about the health and well-being of their furry companions, they are seeking insurance options that offer flexibility in coverage, ranging from accident and illness protection to wellness and preventive care packages. This shift towards personalized insurance solutions is prompting market players to innovate and diversify their product portfolios to meet the evolving demands of pet owners.

Another key trend shaping the pet insurance market is the emphasis on digitalization and technology integration in insurance offerings. With the proliferation of digital platforms and mobile apps, pet insurance providers are leveraging technology to enhance the accessibility and convenience of their services. Features such as online claims processing, real-time policy management, and telemedicine consultations are becoming standard offerings in the pet insurance industry, enabling pet owners to navigate insurance processes seamlessly and stay connected with their pets' healthcare providers.

Furthermore, the expansion of the pet insurance market is being fueled by the increasing partnership collaborations between insurance companies, veterinary clinics, and pet retailers. By forging strategic alliances and joint ventures, market players are not only expanding their market reach but also establishing a seamless ecosystem that integrates insurance services with pet healthcare facilities and retail outlets. These partnerships create value for both pet owners and insurers by providing comprehensive solutions that encompass insurance coverage, veterinary care, and pet supplies under one roof, fostering customer loyalty and retention in a competitive market environment.

Additionally, the evolving regulatory landscape and standards of pet insurance are influencing market dynamics and driving industry players to comply with stringent regulatory requirements. As governments worldwide focus on consumer protection and insurance transparency, pet insurance providers are mandated to uphold ethical business practices, transparent pricing models, and fair claims processing procedures to build trust and credibility among pet owners. Adapting to regulatory changes and ensuring compliance with industry guidelines are imperative for market players to sustain their operations and safeguard their reputation in an increasingly regulated environment.

In conclusion, the pet insurance market is undergoing a transformative phase characterized by innovation, digitalization, strategic partnerships, and regulatory compliance. The convergence of these trends is reshaping the traditional norms of the pet insurance industry and paving the way for a more customer-centric and technologically advanced market ecosystem. To thrive in this evolving landscape, pet insurance providers must remain agile, customer-focused, and proactive in adapting to market trends and consumer preferences to secure a competitive edge in the dynamic pet insurance market.The global pet insurance market is experiencing a remarkable surge in growth driven by several key factors. One of the prominent trends shaping the market is the increasing consumer awareness regarding the benefits of securing insurance coverage for their pets. Pet owners are increasingly recognizing the importance of financial protection to cover the rising healthcare costs associated with pet illnesses and injuries. This heightened awareness, coupled with the trend of humanizing pets and considering them integral members of the family, is propelling the demand for pet insurance products globally.

Moreover, the evolving preferences of pet owners towards personalized insurance plans are reshaping the market landscape. Pet insurance providers are innovating to offer tailored and flexible coverage options that align with the specific needs and preferences of individual pet owners. Customization is becoming a critical differentiator for market players, as pet owners seek comprehensive insurance solutions that cater to the unique healthcare requirements of their beloved pets.

Furthermore, the integration of digital technologies and online platforms is revolutionizing the pet insurance industry. Insurers are leveraging digital tools to enhance the accessibility, convenience, and efficiency of their services. Features such as online claims processing, real-time policy management, and telemedicine consultations are becoming increasingly prevalent, enabling pet owners to manage their insurance plans seamlessly and engage with veterinary care providers remotely. This digital transformation is not only enhancing the customer experience but also driving operational efficiencies for insurance providers in a competitive market environment.

Additionally, strategic partnerships and collaborations within the pet insurance ecosystem are fostering market expansion and customer engagement. By forming alliances with veterinary clinics, pet retailers, and other industry stakeholders, pet insurance providers are creating integrated service offerings that encompass insurance coverage, healthcare services, and pet supplies under one roof. These partnerships are elevating the value proposition for pet owners, streamlining the customer journey, and fostering long-term relationships between insurers and their clientele.

In conclusion, the global pet insurance market is undergoing a paradigm shift driven by factors such as heightened consumer awareness, demand for personalized insurance solutions, digitalization of services, and strategic partnerships. To thrive in this evolving landscape, pet insurance providers must continue to innovate, adapt to changing customer preferences, leverage technology effectively, and cultivate collaborations that add value to the overall pet insurance experience. By staying attuned to market trends and proactively meeting the needs of pet owners, insurers can position themselves for sustained growth and success in the dynamic and competitive pet insurance market.

The Pet Insurance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-pet-insurance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Pet Insurance Market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

- Competitive Assessment:In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

- Market Development:Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

- Market Diversification:Exhaustive information about new products, untapped geographies, recent developments, and investments in the Pet Insurance Market.

Browse More Reports:

Global Autologous Fat Grafting Market

Global Lyophilized Injectable Drugs Market

Asia-Pacific Vanilla (B2C) Market

Global Interventional X-ray Market

Global Automated Sortation System Market

Global Plastic Film Pouches Market

Middle East and Africa Acute Coronary Syndrome Market

Global Nasal Spray Vaccine Market

Global Yeast Probiotic Ingredient for Animal Market

Global Exercise Bike Market

Europe Wood Based Panel Market

Global Optoelectronic Market

Global Gas Chemical Sensor Market

Global Dimethyl Silicone Market

Global Saltwater Batteries Market

Europe Food Grade and Animal Feed Grade Salt Market

Global Biotechnology Tools Market

Global Hybrid Photonic Integrated Circuit Market

Global Wind Turbine Composite Material Market

Global Egg Yolk Replacer Market

North America Blow-Fill-Seal Equipment Market

Global Isoflavones Market

Global Veterinary Oncology Market

Global Healthcare Supply Chain Management Market

Global Fabry Disease Market

Global Frozen Fruit and Vegetable Mix Market

North America Pharmaceutical Solvent Market

Global Doppler Radar Market

Global Abdominal Pain Drugs Market

North America Mycotoxin Testing Market

Global Epigenetics-Based Instruments Market

Europe Vaccine Administration Devices Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Jogos

- Gardening

- Health

- Início

- Literature

- Music

- Networking

- Outro

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness